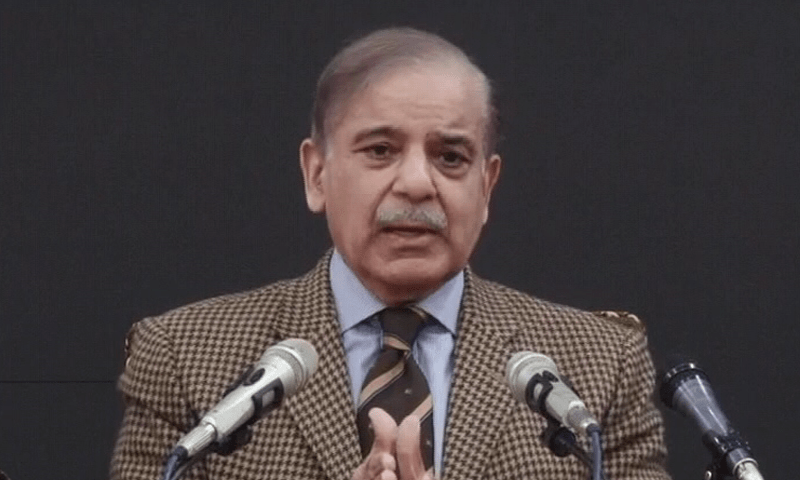

ISLAMABAD: Prime Minister Shehbaz Sharif has given major approval to the proposed automation of the Federal Board of Revenue (FBR) and ordered immediate action for its implementation.

Prime Minister Sharif chaired a high-level meeting on the restructuring of Pakistan International Airlines (PIA) and FBR.

The meeting reviewed in detail the proposals made for the mission of the FBR, transparency of the system, reforms in global standards, raising taxes through incentives, eradication of corruption and smuggling, separation of inland revenue and customs and recommendations for reduction of tax rates.

Prime Minister Sharif ordered the immediate implementation of the proposed plan to automate the FBR to ensure clear timing and speedy execution.

“Setting goals should not only be realistic, but also strive for the fastest possible implementation in terms of action,” said the prime minister. “We have to achieve this goal with continuous hard work, 24 hours a day. We have no more time to waste. It is a matter of Pakistan’s bright future and economic prosperity.”

The Prime Minister directed the Law Ministry to submit immediate recommendations to speed up litigation and resolution of tax collection and revenue disputes in courts, paving the way for transfer of Rs 1.7 trillion to the exchequer.

The Prime Minister directed the Ministry of Law to propose a recommendation on the establishment of a legal department in the FBR, drafting under the law, and the use of legal services, regarding the establishment of a legal department in the FBR, drafting under the law, and the use of legal services.

He said the result of implementing the reforms could increase the national growth rate by 6 to 7 percent.

Also read: Fire breaks out at a factory in Multan

Prime Minister Sharif said that “we must invest in modernizing our revenue and taxation system. We want to introduce an incentive-based tax system. Our desire is to reduce the tax burden, but it will also be necessary to help the business community play its part in the progress of society and the well-being of the people.

The Prime Minister said that “we need to ensure an effective third-party audit system, which has so far been unsuccessful. We can do better by adopting world monetary systems.”

Former Officiating Finance Minister Dr Shamshad Akhtar gave a comprehensive briefing on various aspects of restructuring, automation and future revenue collection agenda during the meeting.

Dr. Akhtar informed the meeting that tax to GDP ratio in Pakistan is just 9.5 percent which needs to be increased to catch up with the competition globally. About 55.6 percent pay no taxes, while only 3.3 percent pay taxes. About 0.2 million people pay 90 percent of the tax, she said.

She said Pakistan’s Rs 1.7 trillion is stuck due to legal disputes. It also shed light on the establishment of a Federal Policy Committee, the creation of a new customs department modeled on other countries, and reforms to the legal and regulatory framework. The proposed Federal Policy Board will formulate long-term tax policy to maintain policy continuity.

The meeting began with the Prime Minister thanking Dr. To Shamshad Akhtar. Prime Minister Shehbaz Sharif said that “today I express my personal gratitude for your efforts. It is a fact that Senator Ishaq Dar laid a solid foundation with the IMF, which later enabled progress in this matter.

It is to be noted that the cabinet sub-committee has already approved the plan for automation and reforms of the FBR and consent to the separation of the Inland Revenue and Customs sectors, but the Income Tax officials have obtained a stay order from the court and the hearing of the case will be held on Thursday.