Harry Johnstone

As a boy Salam Hazar and his family used to relax in a beautiful meadow by Gahkuch, surrounded by emerald-green terraced fields, mulberry and almond trees. They would swim and catch fish in the Gilgit river running through the surrounding Karakoram mountains. It was an idyll. But in the past 20 years, Salam says, the area has been ruined.

“Now I cannot find a space to sit down because there are so many plastic bags on the ground,” he says. “I’m so frustrated.” Plastic waste is spoiling parts of Gilgit-Baltistan, in the far north of Pakistan, as it is so many other beautiful places around the world. But industrial production of plastics is also contributing to the climate crisis. Enterprising Pakistani businesspeople are responding to these challenges, but their success is hugely impacted by the country’s economic environment.

Salam Hazar’s response to the aesthetic, ecological and climate problems caused by plastic waste was to join a reusable bag company, Lokou Trading, started by his cousin Zaheer Abbas. At an unassuming factory off the main road running through Singul town, the firm produces 50,000 nonwoven fabric bags each year. The bags are distributed throughout the country. As well as protecting Pakistan’s biodiversity, Zaheer’s business is contributing to emission reductions.

Caption: Zaheer Abbas (left) founded Lokou Trading to tackle the aesthetic, ecological and climate challenges of plastic waste. Credit: Accelerate Prosperity

Caption: Salam Hazar at the Lokou Trading factory, which produces 50,000 eco-friendly fabric bags each year. Credit: AKDN / Arsalan Haider

Caption: Lokou Trading bags are safeguarding Pakistan’s biodiversity and cutting emissions nationwide. Credit: Accelerate Prosperity

Tackling real market problems

Addressing climate change matters to people in Pakistan. The country is one of the world’s most vulnerable to global heating. Floods pose the biggest danger. The catastrophic flooding in 2022 killed over 1,700 people, and displaced or impacted some 33 million, with damage and economic losses amounting to nearly $30 billion. In the mountainous regions, avalanches, landslides and glacial lake outburst floods pose a constant threat. While megacities like Karachi are likely to experience “deadly heatwaves” of 49°C on an annual basis by 2050, according to the Intergovernmental Panel on Climate Change.

Fortunately, alongside Lokou Trading, there are a host of emerging green businesses in Pakistan transforming this crisis into an opportunity. Kamal Energy is another promising venture. Since launching in 2019, the company has installed around 700 solar-based energy systems for homes, hospitals, schools and offices around the country. CEO Kamal Uddin explains that his business is growing because demand for solar energy is growing.

“It’s an increasing curve,” he says, “Every day, every month. We have more and more people who are trusting this technology.” While so many poorer Pakistanis still rely on burning wood for their energy, growing numbers of people are realising the health and “mood” benefits of clean energy, says Kamal. Cost is also a major factor: the price of energy from solar is less today than it was in 2019. This must be considered in the context of Pakistan’s disastrous levels of inflation, which have contributed to raising electricity prices from the national grid by 40 percent since 2019.

Caption: Kamal Uddin, CEO of Kamal Energy, attributes his company’s growth to the rising demand for solar power. Credit: Accelerate Prosperity

Raza Mohsin is another emerging green entrepreneur, whose electric motorbike company, Vlektra, has begun to gain traction. In 2021, the company began selling its bikes, priced at under $2,000, largely for the domestic market.

“I’m making the cheapest electric motorcycle in the world in our category,” says Raza. Pakistan is “a motorcycle country”, with 1.5 million motorbikes sold annually and 25 million currently in circulation, making it the fourth or fifth largest market globally, he adds. Vlektra sold more than 500 motorbikes in its first 10 months of operations. The company has generated over a million dollars in revenue. Raza is optimistic.

Securing the right capital is obviously crucial to any green startup. The government has sought to support independent renewable energy providers with concessional lending at lower interest rates, even as low as six percent. However, these schemes do not apply to all sectors, such as electric vehicles or circular waste management.

Caption: Pakistan, one of the world’s largest motorcycle markets, is embracing green innovation. Vlektra electric bikes offer affordable, clean transport solutions, tackling real challenges. Credit: Anushay Ruba

Securing startup capital

Accessing capital is generally challenging in Pakistan. “If you’re an early-stage company,” says Naveen Ahmed, a climate finance expert, “access to credit is generally very difficult.” Ahmed highlights two constraints. First, the government is one of the largest borrowers from the private commercial banks, which effectively crowds out private sector investment. Second, the commercial banks offer collateralised lending, but these early-stage companies cannot easily provide such collateral (such as tangible real estate), meaning they fail to qualify for credit.

Then there’s Pakistan’s broader economic context, which is hardly encouraging for green entrepreneurs, unlike in other countries. “In terms of macroeconomics, the government is poor,” says Vlektra founder Raza Mohsin, whose background is in finance. “People pretty much just lost 30 percent of their purchasing power in the past year by virtue of the currency… The government has reduced taxes by about 80 percent, but they’re still charging us taxes. In India or China they’re actually subsidising these businesses.”

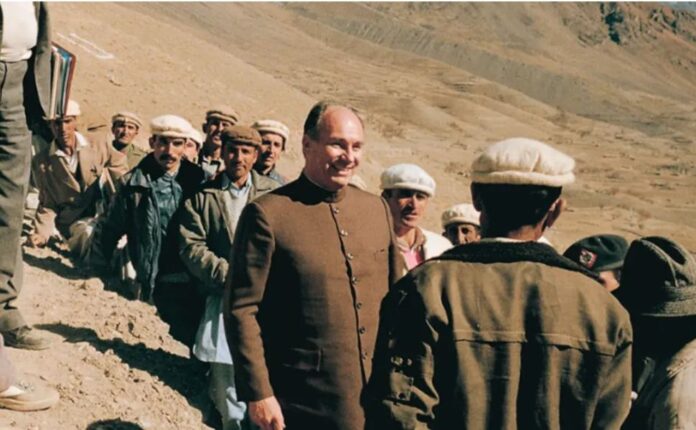

Vlektra was able to raise seed funding through a few private investors. But Lokou Trading and Kamal Energy accessed finance from Accelerate Prosperity (AP). AP is part of the Aga Khan Development Network, a group of development agencies founded by the Aga Khan. It’s an impact investor, meaning its finance is geared not only to deliver profit but also drive social and environmental benefits. AP also provides its clients with business coaching and connects startups to technical expertise, networking and market opportunities. A key advantage of AP’s loans, however, is their interest rates. They are much lower than most banks in Pakistan, which can charge 20 percent or higher.

In spite of the technical constraints for accessing capital and the country’s current inflation woes, the overriding sense is that change is underway in Pakistan. New green businesses are addressing real market problems, like high energy costs. They are appearing in manufacturing, energy, transport and other sectors. A new generation of consumers are realising the co-benefits of these initiatives, including savings in the longer term and improved health. From the gloom of Pakistan’s current predicament, these entrepreneurs are creating new products, services, markets. They are cutting emissions and creating jobs. And with all that comes hope.

—

Harry Johnstone is a freelance journalist, whose reports on climate change and food security issues have appeared in the Financial Times and The Guardian.

This article was supported by the Aga Khan Development Network.