In an important step to facilitate digital transactions in commodity markets, the State Bank of Pakistan (SBP) has temporarily increased transaction and balance limits for various account categories from May 31 to June 20.

The initiative aims to make digital payments safer and more accessible, reducing reliance on cash transactions during the holiday season at farm markets.

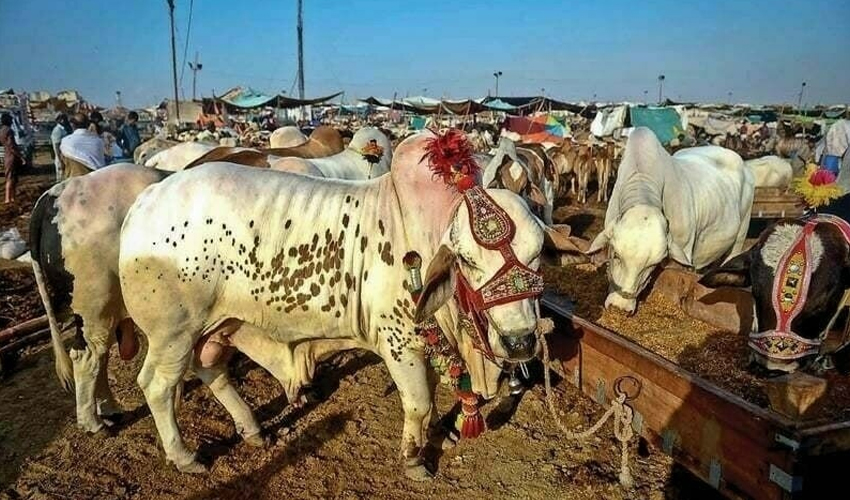

The central bank’s strategy is designed to deal with large cash transactions typically seen in livestock markets around Eid.

By strengthening the digital payment facility, Bank Negara hopes to speed up buying and selling operations, making it safer and more efficient for merchants and customers.

Accounts benefiting from the limit increase include Branchless Banking Tier 1, Aasan Accounts, Aasan Digital Accounts and Merchant Accounts.

For merchants with biometrically verified accounts, the transaction limit has been increased to $5 million and the residual waiver has exceeded the normal limit.